Ever wondered why health insurance seems so complicated, yet crucial, especially now as 2025 unfolds? Surprisingly, the nuances between Thailand and the USA could change everything you knew about coverage! It’s a comparison you didn’t know you needed.

With rising healthcare costs and evolving regulations, understanding these differences is more important than ever. What if you’ve been looking at it all wrong? Health insurance isn’t just about coverage now; it’s about strategic choices that could save your life—or wallet.

Did you know that health insurance plans in Thailand often offer more comprehensive options for herbal treatments, while U.S. plans are more focused on pharmaceutical drugs? Many expats in Thailand are taken aback by the inclusivity of alternative medicine. Imagine paying the same price for a plan that offers you both herbal and conventional treatments—a game changer for anyone seeking holistic health approaches. But that’s not even the wildest part…

In the USA, most people aren’t aware that certain regulations allow insurers to drastically hike premiums based on your zip code, even if you’re in perfect health. It’s a staggering disadvantage that only comes to light when you see your renewal letter. What if there’s a way around this you haven’t considered? The loopholes in these policies might leave you shocked. But wait till you hear what’s next…

What happens next shocked even the experts, as we delve deeper into the unknown dynamics between these two giants' approaches to health insurance. You might find your perspective turned upside down by what follows. Are you ready?

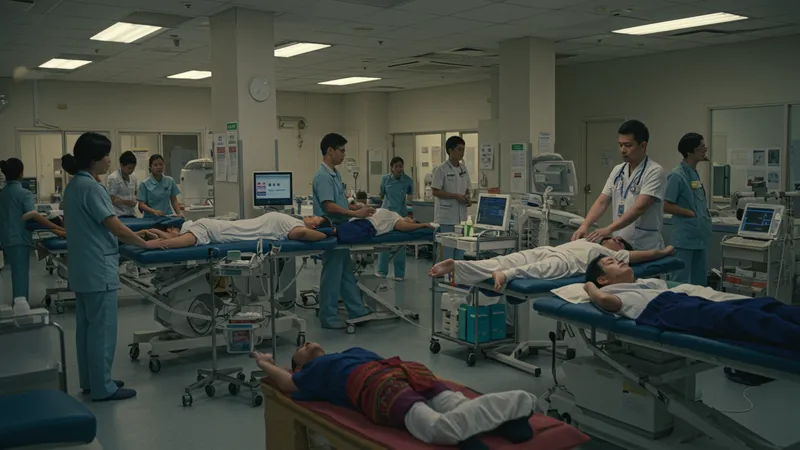

Many foreigners settling in Thailand find themselves mesmerized by the unique benefits offered. Unlike the U.S., Thailand provides extensive networks covering both public and private hospitals with often shorter wait times. An expat once shared how a routine check-up in Bangkok was not only quicker but also medically thorough compared to their U.S. experience. The kicker? It cost a fraction of the price. But here’s another unexpected benefit…

Thailand’s health insurance frequently includes coverage for traditional therapies as part of their standard plans. These treatments—ranging from Thai massage to acupuncture—are not only available but are standard practice in many facilities. Imagine having your insurance support both modern and ancient healing methods seamlessly. For many, this diversity in treatment is a surprising delight. But there’s one more twist to their extensive coverage…

Thai insurance plans sometimes provide incredible overseas coverage, which many expat retirees take advantage of when traveling back to their home countries. The irony here is that while American insurance often limits international coverage, Thai policies encourage it, making global travel more feasible. For those who frequently globe-trot, this can be a massive game-changer. What you read next might change how you see this forever…

While affordability is a major draw, the hidden perks offered by these plans can outweigh many of their U.S. counterparts, reshaping preconceived ideas about where to find quality insurance. This is just the beginning of what you need to know. Ready for the full picture?

Why is it that in Thailand, you can often pay half the price of a U.S. insurance premium and still get more? Many attribute this to the country’s lower cost of living, but insiders reveal another factor. Thai insurance companies also benefit from government incentives designed to bolster medical tourism. This contributes to competitive pricing strategies that appeal to both locals and expats alike. But there’s more to uncover about this pricing paradox…

A closer examination reveals that government support doesn’t just lower premiums—it extends to subsidizing hospital fees as well, which is partially why Thailand can maintain such an economical system. For instance, one expat’s surgery reportedly cost 70% less than what it would in the U.S., without compromising on care quality. But these savings aren’t the only piece of the puzzle…

Many U.S. residents are unaware that the price of their premiums can sometimes cover routine visits for American citizens overseas, which is not often publicized by insurers. The irony lies in having a policy that potentially provides better benefit usage abroad than domestically. This confusion often leads to questions about the logicality of choosing U.S. plans when foreign options seem promising. There’s another layer to this already complex structure…

With multinational corporations increasingly offering Thai-based insurance options to employees, the market competitiveness only intensifies. This not only impacts how residents in both countries view their health care options but also pressures American counterparts to reinvent their offerings. Discover how this shift is impactful as we keep peeling back the layers.

Understanding the fine print of deductibles and maximum coverage limits can make or break your health insurance choice, particularly when comparing two vastly different systems like those in Thailand and the USA. Many find Thai policies often have lower deductibles, which translates to money saved at critical times. However, an expat’s story highlighted a startling twist…

In the U.S., the high deductibles associated with certain plans often deter people from seeking necessary care. Buried within the policy documents are sometimes clauses that exponentially increase these amounts based on usage or specific conditions. It’s a detail often glossed over during initial selection, creating financial blind spots. But there’s something even more peculiar about these figures…

Conversely, Thai plans sometimes feature incredibly low out-of-pocket maximums, effectively capping costs significantly lower than most American plans. This ensures minimal financial distress for policyholders, fostering peace of mind. An aspect often surprising to new expats is the lack of complex tier systems that make U.S. plans convoluted. Curious about how this approach came to be? Here’s the lesser-known story…

The simplicity and transparency of Thai insurance have forced some American insurers to adapt, albeit slowly, by simplifying offerings and adjusting policies to better compete. It’s a fascinating shift that continues to develop as more users voice their preferences for clear, straightforward insurance solutions. Are you intrigued by where this transition leads? Stay tuned, there’s more!

While standard coverage like outpatient visits and surgeries are expected, both Thailand and the USA have unique offerings that surprise many policyholders. In Thailand, the inclusion of coverage for supplementary therapies shocks and pleases expats. These aren’t just add-ons—they’re fully integrated into the healthcare system. But wait until you discover who benefits most…

The USA, known for its pragmatic approach, has started including mental health under many newer policies—albeit at a premium. This marks a progressive shift in recognizing mental wellness on par with physical health, despite the higher price. Yet, you might be surprised to learn about some policies’ exclusions that could affect essential care. What could those be?

It turns out many plans in both countries emphasize preventative care, aiming to reduce major medical interventions down the road. This trend has been particularly noted in urban centers where awareness and focus on holistic health are growing. However, specifics about qualified preventatives can be elusive, complicating actual implementation. And there’s another unforeseen benefit of these policies…

Thai insurers are pioneering plans that integrate modern technology, offering virtual consultations as a standard practice. On the other hand, the U.S. remains caught in red tape over telemedicine’s comprehensive coverage. This divide not only showcases innovation but points to a fundamental difference in healthcare progression. What does this mean for the future’s competitive landscape? We’re just scratching the surface.

Advancements in technology have deeply impacted health insurance, transforming how policies are administered and accessed. In Thailand, insurers are at the forefront of leveraging tech to streamline patient experiences through AI-driven customer service platforms. These innovations simplify plan management, unlike the cumbersome U.S. systems. But there’s more to this tech transformation…

Telemedicine, a growing field globally, sees different adoption levels. In Thailand, insurers readily offer telehealth services as an integral component of their plans, easing access to healthcare professionals. Meanwhile, in the U.S., there’s an ongoing debate about the cost-effectiveness and insurance coverage for such services. The discrepancy is quite striking. More complexities unfold around these technological shifts…

Some U.S. insurers are beginning to embrace blockchain technology to enhance transparency and security in processing claims. Though still in the early stages, this move aims to reduce fraud and administrative burdens. In contrast, Thai insurers focus on mobile apps for instant policy detail access—a boon for the tech-savvy user. Intrigued by how these trends will evolve? Just wait, there’s more to find out…

As both nations advance technologically, the direction they choose could greatly impact the attractiveness of their health insurance plans. Will the U.S. catch up to the digital ease that Thailand provides, or will its slow pace leave room for more global influence? This unfolding story is one to keep track of, and we’ve just begun exploring its implications.

Health insurance systems globally face unique challenges, yet there’s a growing trend of learning cross-nationally. Thailand and the USA, while different in many respects, offer lessons via their healthcare exchanges. Cooperation and study tours are more frequent, and interesting policies are emerging from these dialogues. But here’s the surprising part…

The USA has begun to show an interest in the affordability and accessibility of Thailand’s universal health system, a stark contrast to its traditional preference for private health provision. Could adopting some elements lead to a breakthrough in coverage expansion? Conversely, Thailand watches the U.S. innovation in technological integration for insights—foreshadowing a potential paradigm shift…

Despite Thailand’s advancements, challenges remain over resource allocation and ensuring health equity, borrowing elements from the U.S. insurance model. However, Thai insurers remain committed to innovation, constantly re-evaluating policies. It’s a curious cycle of borrowing and adapting across continents that shapes evolving health care landscapes. Another significant insight awaits…

With these exchanges fostering mutual growth, both nations might redefine global insurance standards, improving patient care worldwide. Such continuous dialogue is empowering, and the culmination of these collaborative efforts is something to look forward to. As we explore how this impacts you directly, prepare for a compelling end to this insightful journey.

Cultural attitudes towards health care deeply influence insurance preferences. In Thailand, there’s a strong emphasis on holistic care, leading to wider acceptance and demand for policies covering diverse treatments. This cultural inclination steers insurers to enhance benefits that cater to well-being beyond medical needs. But the surprising belief among locals is…

Conversely, in the U.S., the perception of insurance is more of a necessity than a wellness choice, often driven by regulation and employer expectations. The stark difference in perception leads to highly varied plan structures, impacting consumer choice and satisfaction levels. But another wrinkle in these culturally-rooted differences impacts policy design…

For instance, in Thailand, trust in alternative medicine's efficacy remains high, leading insurers to naturally incorporate it into policies, appealing to both expats and locals alike. The U.S., grappling with scientific validation, tends to remain cautious. This divergence prompts ongoing discussions about coverage diversification. Unraveling this is pivotal to understanding the future…

Acknowledging cultural values is crucial in creating fulfilling insurance experiences. With increasing globalization, these values could shape future policy offerings worldwide, creating a melting pot of culturally sensitive healthcare solutions. Curious about where this could take us? This exploration is far from over, and the continuation is captivating.

The fine print in insurance policies is notorious for being a minefield of hidden details and restrictions. In Thailand, clarity and transparency often lead the charge in policy presentations, making it easier for consumers to grasp their benefits and obligations fully. But there’s a catch that many don’t see coming…

In the USA, the complexity of language and regulation leaves many policyholders bewildered. A common grievance is the labyrinthine complexity of terms, making informed choices challenging. Despite this, insiders suggest ways to decode these plans effectively. But even with clarity, there are other nuances…

One recurring issue in both countries is the propensity for policies to exclude pre-existing conditions unless meticulously declared—a point overlooked by many during sign-up, leading to later denials. Understanding such exclusions is essential to avoid unexpected financial burdens. Yet, it's not solely about policy details…

Decoding these intricacies requires more than patience; it needs advocacy and awareness to tilt the balance in favor of consumers. Navigating through, many have found unexpected solutions, proving that understanding isn’t beyond reach. Explore these strategies as we move through what promises to be an enlightening look at decoding health insurance.

For expats living abroad, selecting the right health insurance is fraught with challenges and unknowns. In Thailand, the choices available are plentiful; however, the quality and reliability of these options often come into question, leaving many unsure. But there is an unseen advantage…

The ultimate dilemma involves balancing cost against coverage—often a central theme when choosing between international insurance plans and local policies. Misjudging this balance might lead to under-insurance or overpayment, crucial aspects that demand scrutiny. But there’s still another layer at play…

In the USA, an increasingly large expat-focused barrier involves navigating bureaucratic hurdles that restrict smooth enrolment, leading to possible lapses. Crafting an insurance strategy that encompasses multiple eventualities can offset such issues, offering peace of mind. What can expats learn to overcome these hurdles?

Experienced expats have shared insights into mastering these choices, suggesting frameworks that simplify decision-making. These effective methods not only ensure adequate coverage but also reveal surprising cost-efficiencies through conscious policy selection. Discover these adaptable strategies, and see how an informed choice transforms the expat insurance experience.

Medical tourism, an upward trend among expats, relies heavily on suitable insurance arrangements to leverage cost savings and quality care. Thailand’s status as a medical hub enhances this practice, providing diverse, affordable services with quality assurance. But there’s a hidden catch to consider…

In the USA, insurance plays a pivotal role in facilitating this, though skepticism remains high due to potential hidden costs or inadequate coverage. It’s crucial to discern which plans extend appropriate benefits for international procedures without exposing policyholders to excessive risks. However, there's more you should know…

The concept of bilateral agreements between insurers abroad further complicates the landscape, yet offers enhanced coverage adaptability for frequent travelers or procedures. Understanding such agreements aids in maximizing insurance benefits, mitigating any unseen financial pitfalls. Then there’s the strategic element involved…

Strategically planning medical tourism through the lens of insurance reveals benefits often missed by casual seekers. Experienced participants emphasize the strategic preparation around plan selection, avoiding common pitfalls while enjoying the economic and medical advantages of such endeavors. This guide reveals methods to fully harness these insights, keeping you informed and prepared.

The debate between public and private insurance stirs continuously, with profound implications for services and coverage. Thailand’s public system offers comprehensive services, albeit with longer wait times, pushing many towards private alternatives for expediency. But its implications extend further…

In contrast, the USA remains entrenched in a predominantly private system with varying service quality. Public options, though limited, often struggle against this backdrop, influencing many citizens to seek self-funded private plans. But within this dichotomy lies an unexpected insight…

Public systems in both countries have structured more inclusive, though often slower, service experiences which some still prefer. Meanwhile, private systems promise speed and perceived quality improvements, attracting those prioritizing these aspects. However, opinions diverge substantially here…

These contrasts fuel an evolving dialogue around health insurance viability and preferences globally, encouraging reforms and hybrid system models adeptly combining public oversight with private efficiency. Such discourse shapes the potential future of healthcare, revealing a nuanced pathway toward an ideal system mix yet to be achieved.

Redefining value in health insurance guides pivotal decisions for both providers and consumers. Thailand’s competitive landscape fosters a value-focused culture emphasizing comprehensive, affordable coverage as a priority. But surprisingly, this pursuit isn’t purely price-driven…

The USA sees a similar redefinition, yet the high cost of innovative treatments advances comparative valuation. Consumers now demand more transparency, tying value to treatment outcomes and policy flexibility rather than just financial metrics. Interestingly, there’s a broader impact here…

As health landscapes evolve, customer-centric policies blending cost-efficiency with effective healthcare are unfolding in both countries. Such a revolutionary shift mandates insurers demonstrate tangible value beyond actuarial tables, building consumer trust comprehensively. Have you considered how value perception might change in years to come?

The transformation in defining insurance value propels industry changes, pressing for adaptable offerings aligning with forward-thinking healthcare methodologies. Examine these evolving perceptions and unearth how they might influence your future insurance decisions, ensuring educated, empowered choices.

Anticipating future trends uncovers transformative elements redefining global health insurance landscapes. Thailand and the USA, while diverse, share some parallel pathways prompted by innovation, regulatory shifts, and international challenges. But amid this evolution lies an emerging surprise…

Technology drives substantial changes across both nations; yet regulatory responsiveness highlights a curious disparity. Thai insurers have adapted swiftly to digital advancements, contrasting the often slower U.S. pace grappling with policy constraints. Nevertheless, there remains a unifying vision…

Many foresee increased collaboration between health systems globally, adapting cross-border innovations into hybrid models. Such exchanges promise expansive, yet cohesive solutions tailored for a global clientele, boosting access and efficiency. But how will this impact you personally?

These prospective shifts come with both opportunities and challenges, ensuring health insurance aligns more closely with universal needs. This global synergy molds a more robust future, shaping coverage developments compatible with diverse user needs. Stay informed—your choices tomorrow could depend on understanding today’s evolving horizon.

Finally, as we draw this fascinating exploration to a close, the intricate tapestry of health insurance across Thailand and the USA reveals more than mere comparisons. It's a lesson in adaptability and global collaboration driving healthcare forward, ensuring future resilience and accessibility. Now's the time to delve into your health insurance strategy. Share this article, bookmark for insightful strategies, and embark on informed decisions!