Imagine you’re sipping coffee at your desk when you receive a letter that changes everything: you're being sued. Without liability insurance, this could mean financial ruin.

In today's litigation-prone society, liability insurance is more critical than ever. Can you afford to leave your assets vulnerable?

The stunning truth is, most people don’t know just how vulnerable they are without proper liability insurance. You might think your assets and lifestyle are protected, but you might be wrong. Recent reports show that lawsuits are more common than ever, with settlements soaring into millions. But that's not even the wildest part...

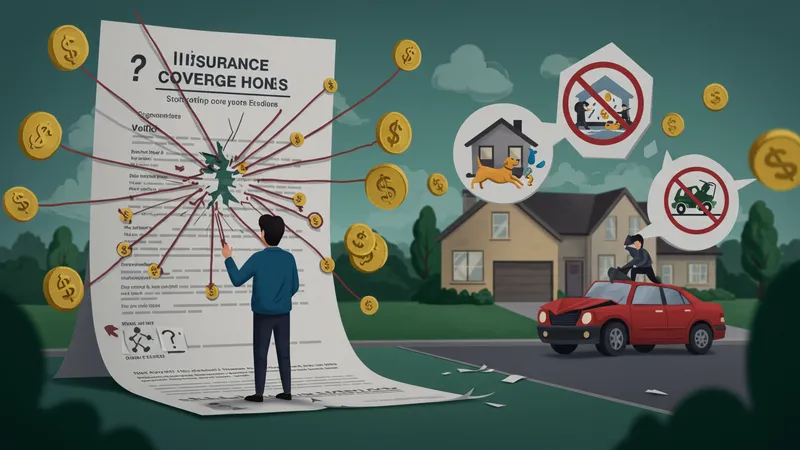

What if I told you that even those with existing insurance might not be fully covered due to common policy misunderstandings? That's right, hidden clauses and exemptions can leave you high and dry in a lawsuit. This misconception has caught even seasoned experts off guard. But the surprises don’t stop here...

You might think securing appropriate liability insurance is simply about choosing the right plan, but the rabbit hole goes much deeper. What happens next shocked even the experts…

When most people consider liability insurance, they often assume a single policy covers all potential risks. However, the reality can be starkly different. Many standard home and auto insurance policies include gaps, especially when it comes to high-limit claims. For instance, while it may seem comprehensive, a homeowner's policy may not cover certain accidents or dog bites, which could lead to unexpected out-of-pocket expenses.

Moreover, most are shocked to learn that liability limits often don't account for inflation or the rising cost of medical bills, meaning a tragic accident could easily exceed your coverage. But don’t panic just yet; there are strategies to bridge these gaps you might not be aware of. What you’re about to read might completely alter your understanding of coverage needs.

Umbrella policies come into play here, providing excess coverage beyond standard policies. Yet, many policyholders are unaware these exist or assume they’re prohibitively expensive. The truth? Umbrella policies can start as low as $150 a year while offering millions in additional coverage. But there's one more twist: selecting the right provider is crucial.

Some insurance companies embed fine print that can nullify parts of your umbrella coverage under specific conditions, such as engaging in certain hobbies or hosting events. This insider insight is key to ensuring you have full protection. But before you dive into purchasing an umbrella policy, there’s an undiscovered factor that could save or sink you financially...

Did you know that an overwhelming number of policyholders are underinsured without realizing it? This oversight often surfaces during the worst possible moments—right in the heat of a legal battle. Shockingly, 60% of businesses and individuals unknowingly fall under this category, leading to financial shocks that could have been avoided.

For example, business owners often assume their standard liability policy will protect against everything from slip and fall incidents to employee-related claims. However, exclusions related to cyber threats or personal injury claims can leave businesses exposed, facing potential bankruptcy.

The devil is in the details. Policies can be baffling, with terminology that seems intentionally obfuscating. Many people, in attempts to save on premiums, unknowingly lower critical coverage thresholds, trading short-term savings for long-term risk. But here’s a curious point: what if enhancing your coverage was simpler—and cheaper—than you thought?

A sit-down with a knowledgeable insurance advisor can not only illuminate these gaps but also reveal discounts and bundling opportunities that can prevent your financial woes. However, it’s not enough to just know what’s missing—where you get enlightened could alter the arc of your financial future.

Being insured while driving is a given, yet did you know many motorists are cruising around with coverage that may not protect them entirely? Most drivers are lulled into a false sense of security with their auto policies, not realizing the potential gaping holes until faced with a claim.

Roadside incidents can quickly escalate in cost, pushing beyond the limits of average policies. Add to that, uninsured and underinsured motorist coverage is frequently undervalued, despite being instrumental in protecting against others’ insurance shortcomings.

Surprisingly, minor adjustments in these policy specifics can make significant differences. Raising your uninsured motorist coverage doesn’t skyrocket premiums but shields against costly outcomes when the other party is at fault and uninsured. But there’s an element of this coverage that even seasoned drivers are unaware of...

A key twist lies in the restricted scope of coverage for certain vehicle types and informal carpooling arrangements, which many drivers partake in regularly. This nuance is often overlooked yet bears substantial impact, leaving unsuspecting drivers vulnerable. Could your daily commute hold the overlooked cause of impending financial bitterness?

With the gig economy booming, freelancers are thriving, yet a silent risk shadows this freedom. Personal liability insurance is often relegated as unnecessary for freelancers until a simple client mishap turns litigious, threatening their entire livelihood.

Freelancers often dismiss the need, convinced their field doesn't entail significant risk. However, consider the implication of a data breach, intellectual property disputes, or even injury claims if work is conducted on client premises. Each scenario harbors the potential to unravel one’s financial stability.

This hidden pitfall frequently goes unnoticed until it's irreversibly too late, with many discovering too late their general liability insurance falls short. More than low-cost-options exist, providing viable coverage for an array of freelance risks.

The looming question that they face: are you willing to stake your future on hope alone, or uncover how strategic coverage could shield not just your finances, but your career trajectory? In this realm, foresight—not oversight—bridges the gap between risk and security.

Your castle is supposed to be safe, but did you know home liability coverage often conceals unexpected exclusions that only become apparent when it’s too late? Issues extend beyond mere structural damage but also encompass mishaps you’d never foresee.

Pool areas, trampolines, and even certain home renovations can void parts of your liability coverage in the event of an accident. This often-hidden tidbit catapults homeowners into treacherous legal waters, especially if injuries occur on their property.

To counteract, homeowners can integrate safety measures into insurance discussions, sometimes securing lower premiums while enhancing coverage. Consider implementing routine checks, safety installations, and open dialogue with your insurer.

Yet, don’t let mere safety nets distract you from broader coverage strategies. You might unearth a tactic that reinforces protection against unforeseen, high-cost claims. So, could vigilance now save an exorbitant heartache later?

For many entrepreneurs, business liability insurance is perceived as a mere checkbox. Yet beneath this guise lies a complex matrix of policy-specific nuances that, if overlooked, can cripple a young business.

Common pitfalls include misidentifying employee roles or insufficient coverage for out-of-office events, which can leave gaps critical at claim time. Mistakes like these frustrate business owners when cash flow is already strained.

Perhaps the intriguing aspect is how seamless policy adjustments can buffer these risks. By redefining covered roles and activities, businesses leverage more protective stances, considering all operational possibilities.

But the crucial decision remains: will you place your burgeoning enterprise's fate in assumptions, or capitalize on strategic, tailored coverage insights? This is where the risk of overlooking mistakes of the past becomes the opportunity of future foresight.

Even healthcare professionals find themselves entangled in liability policy myths, leaving them precariously uncovered in certain scenarios. Oftentimes, these omissions remain until the brunt of a malpractice claim emerges.

It’s surprising how many medical practitioners overlook coverage limits and constraints that exclude specific procedures or emerging technologies not explicitly listed. These blind spots can translate into crushing financial burdens.

Knowing the gamut of patient services and related risks serves as a linchpin for developing more comprehensive coverage strategies. Adjusting limits accordingly, based on procedural diversity, can hedge against potential gaps.

Cementing a strong insurance foundation relies heavily on ongoing assessments and adapting to current practice changes. Thus, the question remains: in the realm of health, can you afford gaps in coverage when lives, and livelihoods, wordlessly depend on them?

Tourism businesses walk on a tightrope with liability insurance, balancing between service offerings and client safety. This industry is often blindsided by unexpected incidents that typical policies might not encompass.

Consider the overlooked liability of natural disaster impacts on tours, or even physical injuries during excursions. Such moments hold potentially devastating legal implications if not preempted by comprehensive coverage plans.

Curiously, bundling policies present intriguing ways to mitigate these risks effectively. Creating a cohesive safety net through policy overlap can ensure more solid protection against the varied aspects of operation.

But as the travel landscape continually adapts and evolves, safeguarding guests and assets alike becomes an ongoing endeavor. Could the steps taken now avert the sprawling impacts of a precarious tourism dynamic in the future?

Property ownership might seem straightforward, yet looming liabilities lurk unseen until a mishap happens. Liability policies often miss potential legal drawbacks of rental activities or property improvements.

The shock here is that many property owners skimp on crucial coverages to reduce premiums only to realize this mistake when facing tenant lawsuits or neighborhood claims. The fine print remains the unspoken struggle.

A distinctive approach to fortifying real estate investments is strategizing coverage requirements with projected property developments and leasing arrangements in mind. This proactive stance can bridge common misunderstanding gaps in policy terms.

Therefore, astute navigation of hidden policy intricacies translates into not just peace of mind but stable financial assurance. How do current coverage gaps reconcile with a future of burgeoning real estate operations?

Travel liability is gaming-changing, bound with assumptions that acts of God or unforeseeable events are comprehensively covered under standard policies. But even experienced travelers face potential ambiguous exclusions unaware.

For instance, many are startled by the lack of coverage for epidemics, natural disasters, or political unrest—a risk territory left largely undefended unless specifically accounted for in policy terms.

With grounded knowledge of how to pivot liability measures, from understanding international coverage nuances to opting for specialized global policies, travelers can secure their adventures effectively.

In an ever-fluctuating travel ecosystem, preparation isn’t merely advisable; it becomes transformation of consciousness and maintenance of absolute safety against unpredicted threats.

In a world where digital presence is ubiquitous, liability coverage for online activities is a mystifying, often neglected aspect. Most policies gloss over unauthorized digital content or dereliction of online responsibilities.

The real revelation: even simplified digital liabilities can bring forth tangled legal proceedings. Examining current specifics highlights existing loopholes concerning social media practices or online business transactions.

An informed reader can find solace by investing in narrowly tailored cyber liability policies that satisfactorily cover digital engagements and potential fallout from the same.

The ultimate inquiry maintains momentum: how can evolving digital landscapes continue shaping adequate liability paradigms meeting contemporary online challenges?

Often underappreciated, environmental liability coverage is crucial as environmental accountability steps into policy limelight. Common misconceptions among stakeholders lead to unattended environmental mishaps.

With growing demand for sustainable practices, the intersection of business operations and ecological impact breeds potential legal exposure, scarcely mitigated by traditional policies.

Proactive adjustments to anticipatory environmental considerations while refining coverage specifics assures adept navigation of legal landscapes, seldom explored by conventional businesses.

As ecological initiatives persevere in prominence, fundamentally adapting to these changes becomes intrinsic to future liability discourse, for practically ensuring viable operation amidst prevailing environmental paradigms.

As digitization prevails, the cavalier attitude towards cyber liability stands startlingly unalarmed, despite obvious implications of a data breach’s aftermath. Insurance inadequacies obscure cybersecurity focus.

Exposed vulnerabilities, from phishing schemes to direct hacks, amplify incessant liability discourse—especially when coverage isn’t precisely appropriated to safeguard sensitive data!

To combat, proactive leaders reimagine cybersecurity liability through comprehensive operator policies with swiftly aligned coverage—effectual adaptations derived from continuous security assessments.

In the face of unpredictable cyber operations, rotating liability strategies secure more than data; they nurture evolution into a bastion of proactive defense, enriching digital trusts diversely!

Art galleries and exhibits often innocently skip discussing liability, yet from installations to artwork protection, these spaces conceal unexpected risk. Surprisingly, accidents or unspoken damage expose liability weak points.

Errors and omissions within art-related services breed financial calamity from fragile negligence, valuating quintessential safety priorities to impeccable standards with coverage adaptation at heart.

By considering targeted policies, immersive art contexts gate vulnerability points that shield works, clientele, and creative expressions with revitalized efficiency.

Herein lies an unseen panorama entrenched within artistic spheres: Not merely preserving antiquities, but traversing forth into avant-garde coverage assuring resiliency under risk.

In the climate of ubiquitous liability, robust policies resemble nothing short of a strategic masterpiece—bold, resilient, and anticipatory. As these concealed facets unravel, they summon an unequivocal call for re-evaluation and reinforcement across various spectrums.

Seize this insight as a fulcrum of action: reassess existing coverages, plug the knowledge gaps, and share the revelations. Spread awareness because, in the end, security is a shared endeavor. Chart your course today—redefine what protection truly encapsulates!