Did you know that the perfect health insurance plan can save Indian families nearly Rs. 1 lakh every year? Yet, most people are stuck with plans that barely cover their needs. It's time to rethink how we choose.

With medical inflation climbing like never before, finding the right health insurance is more crucial than ever. With unique options emerging, can you afford to miss the latest insights on family coverage?

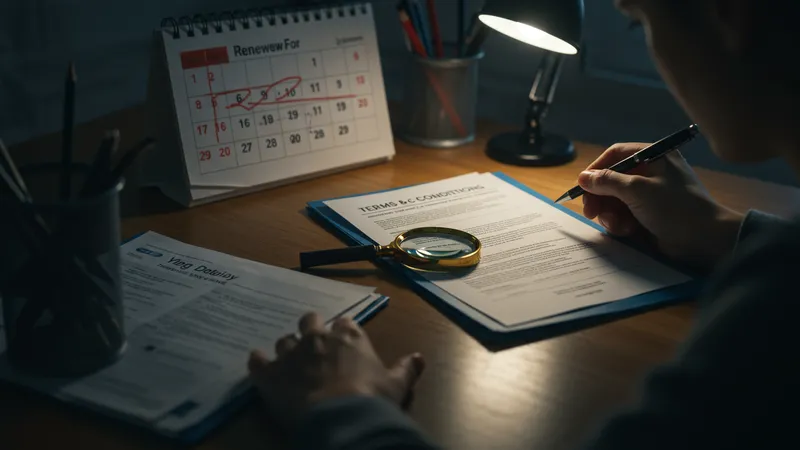

You might think you know how to compare and purchase health insurance, but prepare to challenge everything you've ever learned. For example, many plans highlight lack-luster perks while hiding key limitations in the fine print. Yet, most families do not measure the true "post-expense" value of their coverage. The devil is in the details – or lack thereof. But that’s not even the wildest part…

Some plans now provide futuristic benefits that weren't even on our radar just five years ago. From unlimited teleconsultations to surgical penalties and rewards, you'll want to see what's under the hood of today’s plans. Insurance companies are betting on new trends, and families need to be savvier than ever to come out on top. What happens next shocked even the experts…

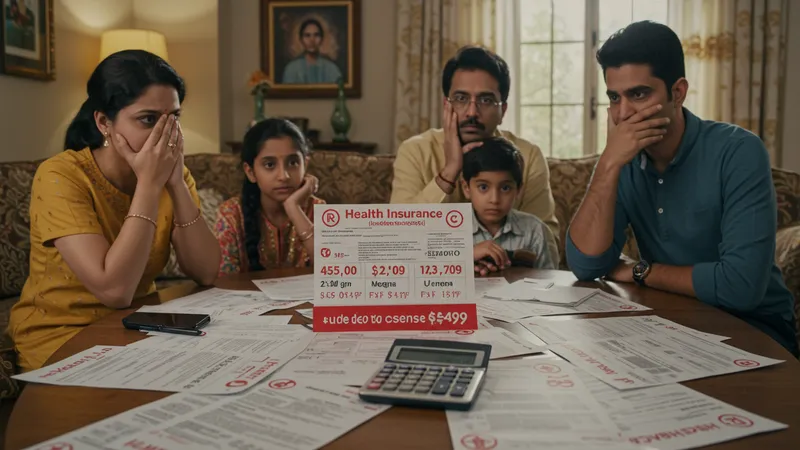

Many Indian families are unaware of the hidden costs lurking in their health insurance plans. These can range from undisclosed co-payments to steep renewal fees. This lack of transparency can escalate annual medical expenses by 20%. Families often realize this too late, trapped by alluring initial discounts.

But understanding these hidden fees is crucial to picking the right plan. Experts suggest scrutinizing the policy wording or opting for plans that offer a detailed break-up of all potential costs, before you sign on the dotted line. But there’s one more twist…

A surprising number of policyholders also ignore the waiting period clauses. Critical hospitalizations can quickly turn into financial nightmares if these clauses aren’t understood. Insurers banking on customer oversight means they often bury this information. However, reading between the lines could change a family's financial trajectory.

Educating yourself on what insurers don't want you to know can mean the difference between financial security and devastating loss. What you read next might change how you see this forever.

The 2025 health insurance plans come with perks that traditional policies never offered. Imagine having unlimited doctor consultations without additional charges or access to alternative medicine treatments included in your policy. These cutting-edge features aren't just industry buzzwords; they're redefining coverage as we know it.

But these aren’t always highlighted. Instead, many policies focus on traditional aspects like hospitalization coverage. Consumers should be actively seeking plans that provide these novel benefits. Missing out could mean paying out-of-pocket for highly sought-after alternative therapies or consultations.

Moreover, some insurers offer wellness programs to encourage a healthier lifestyle. These incentives are part of a modern shift to preventive care. Utilizing these features can not only maintain health but also potentially reduce premiums over time. There's more to this trend than meets the eye…

This new era of health insurance demands a keen eye to sift through extensive offerings and unearth benefits that cater precisely to a family's needs. But how do these perks stack up against coverage limitations? Keep reading to discover what’s still being hidden.

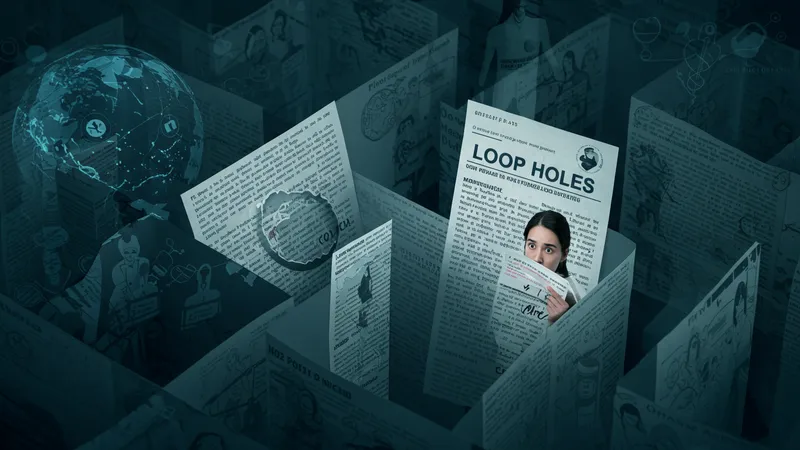

Just as you feel secure with your plan, there are loopholes waiting to catch you off-guard. Policies often have fine print that negates what seems like comprehensive coverage. Take overseas medical emergencies, for example. Some plans that claim to offer international coverage have restrictions that only apply under certain conditions.

Not to mention policies that sneakily exclude payments for pre-existing conditions within a stipulated period. Despite being legally obligated to cover pre-existing issues after a few years, insurers use nuanced legal language to delay claims.

What’s important is understanding that not everything promised upfront aligns with what's deliverable in various scenarios. Knowing these shortfalls before committing can save heartache and money. But the biggest shocker of all is yet to come…

Navigating these choppy waters requires dedicated research and often questioning what seems obvious. What you discover next might just empower you to rewrite the rules.

Todays' health insurance market thrives on comparison. With new tools like AI-driven platforms that suggest the best policy for your unique needs, the era of static insurance is over. Companies now face techno-savvy consumers equipped to compare endless options.

Gone are the days of sticking with legacy insurers. Dynamic comparison websites allow consumers to switch policies with the click of a button, maximizing benefits and shedding unnecessary costs. But what ensures these tools work in your favor?

Transparency. Understanding the metrics used by comparison algorithms can help select the most suitable plan. Taking advantage of technological advancements allows families to sculpt their ideal coverage landscape.

The secrets to leverage these breakthroughs effectively will change how you pick your next insurance plan. Don’t get left behind; the future favors the informed consumer.

The shift to digital has dramatically altered how we buy health insurance. Today, policy comparisons happen at the swipe of a finger. Interactive platforms let consumers better understand benefits and limitations within moments.

Yet, while technology simplifies choices, the process can become overwhelming if not approached correctly. New tools help cut through the noise, filtering the best options—instead of wading through an endless flow of data.

Insurers are also adapting. Realizing the need for transparency and efficiency, they offer real-time chat support and intuitive apps to personalize the experience. Still, the question remains: how to efficiently balance technological advances with knowledgeable decision-making?

Gleaning insights from digital buying experiences uncovers how to tip the scale in favor of buyers—a few subtle tweaks and the power shifts. Stick around, the best is yet to come.

As new policies are introduced, certain hidden features can dramatically change a family's coverage. For instance, the inclusion of comprehensive mental health support is a game-changer not many plans provide. This also has the potential to impact premiums favorably.

Families overlooked provisions could also be found in wellness incentives, offering financial rewards for maintaining healthy lifestyles. These components, though not overtly highlighted, can influence a decision significantly.

Moreover, policies that consider holistic family health, incorporating alternative therapies and specialized pediatrics, are worth their weight in gold. Families should dig deep for these gems in policy terms.

These obscure provisions might just redefine your family's future coverage. What hidden feature will you uncover next that changes it all?

Family floater plans present a compelling option as coverage is extended across all members using a single sum insured. This contrasts starkly with individual coverages, making them particularly cost-effective.

But often, these plans come with a catch. Misunderstanding shared limits across members can lead to paying more out-of-pocket during critical scenarios. Policy terms outline conditions with specific exclusions and limitations which must be understood.

Understanding nuances like entry age limits and specific illnesses exclusions can save shock and financial burden. It's pivotal to analyze these stipulations before selecting a floater plan.

As we unravel more complexities, could these shared insurances be a fit for your unique familial needs? The right answer goes beyond surface understanding.

Endorsed by employers, group insurance policies offer affordable, extensive coverage but leave major gaps. Despite the initial appeal, switch jobs or retire, and the coverage vanishes.

Such policies often disappoint in customization—important health needs might be overlooked. Relying solely on these plans may result in shortcomings during emergencies.

On the plus side, group insurance can provide baseline coverage, but experts suggest combining with individual policies for comprehensive security. Mixing both might protect against unexpected policy changes.

There's potential to leverage these twin assets, but the real value lies in your strategy. What blend creates the optimal safety net?

Critical illness coverage insures against diseases like cancer and heart ailments that are often brushed aside by basic plans. Yet many still underestimate its role, risking financial health.

These diseases come with high treatment costs, causing significant economic strain without special coverage. Plans often cover specific named illnesses, a factor overlooked initially due to perceived exclusivity.

Scrutinizing illness riders and exclusions can impact long-term health financial planning, ensuring comprehensive safety. Families that integrate critical illness with their policies cover themselves against high-risk odds.

Delving deeper, could this be the missing piece of your family's insurance jigsaw? It might be the best takeaway from today’s insights.

Health insurance isn't just about today; it's about securing the future. Polices pave the way for quality healthcare access for future generations—an investment often overshadowed.

Children's coverage starts as an ancillary benefit but grows, becoming crucial as they approach independent adulthood. Parents often miss customizing plans early, failing to address children's unique health needs.

Visionary parents craft policies tailored for evolving needs, ensuring their children inherit the best medical support. This foresight lays the groundwork for continued health and financial stability.

As we tie these insights into the future, how are you preparing your family's legacy in health? An informed strategy today seeds prosperity tomorrow.

Innovations in insurance policies are disrupting norms. Telemedicine, AI health predictions, and wellness wearables are rapidly becoming indispensable in modern coverage plans. Adaptation is key.

Those ahead of the curve are experiencing unprecedented perks—premium reductions and policy customizations like never before. However, unawareness means missing out remarkably.

As technology integrates into healthcare, it’s critical to align policy choices with technological advancements. This synergy can streamline costs and pre-empt health issues, reshaping Indian family health dynamics.

Are you positioned to surf this wave of innovation? The strategic choice today will echo through the generational staircase.

Insurance agencies increasingly allow consumers to cherry-pick benefits, creating 'personalized plans'. Customization options can seem daunting yet armed with knowledge, families can design near-perfect coverage.

This ease translates into tailored supports like maternity care or chronic illness needs adapted to specific family circumstances. However, consumers need to understand the musts and eliminate the frills.

Optimization strategy revolves around balancing premiums with essential coverage. Families strategizing correctly unlock both savings and extensive benefits.

Customizing—an art and science—becomes a pillar of robust family health strategies. Don’t settle for less when customization opens doors to comprehensive security.

Meet Raj and Priya—a couple who, by harnessing the flexibility of customized health policies, dramatically slashed their healthcare expenses while enjoying extensive perks skipped by many.

By fine-tuning coverage to include newborn care, dental treatments, and alternative therapies, their family experienced holistic health protection. Unparalleled security met affordability, proving intertwined possibilities.

This inspired others, spreading awareness of benefits reaped through scrutinized choices. What they found is that diligence rewarded them with unforeseen peace of mind.

A success story that became exemplary, inviting conversations on strategies; it's a truth you can adopt. What steps will you take upon these lessons?

Renewals, often left till last minute, are crucial yet perilous moments. They affect coverage continuity and premium costs—both essential elements dictating future security.

Many realize costly oversights when terms shift unfavorably during renewal. Painstaking attention to changes can preempt common pitfalls and assure plan stability.

Understanding your position—whether it's time for strategic shifts or remaining steady—can substantially affect your insurance's value proposition.

This overlooked segment holds transformative capacity for family health finance. What renewal strategies will secure robustness and transparency for you?

Industries’ insiders stress tips that enhance coverage. Leveraging family floater plans stimulates greater unity across members, optimizing premium economics effectively.

Additionally, timely upgrades to existing plans sync with evolving family needs. Clarity in coverage can overtime lead to significant cost savings.

Pioneering these insider insights steady insurance objectives, ensuring your family transforms coverages into actionable safety nets. Discover how small adjustments redefine substantial future wellness.

A culmination of expertise opens insights awaiting adoption. What hidden gems will you uncover—or refine—that redirect family health insurance strategies to optimality?

As you draw this comparative journey to a close, remember: careful selection and regular policy review underscore the essence of family health insurance strategy. By harnessing available resources smartly, Indian families can not only secure health but fortify their financial stability against medical uncertainties. Share these insights, bookmark them, or act on them today, because the power of informed decision-making lies in your hands—securing a future that’s both healthy and financially sound.