Did you know that over 50 million travelers were stranded without the safety of insurance last year? Shocking, isn’t it? Especially since travel insurance can often mean the difference between a small misstep and a colossal financial disaster.

As the world reopens and wanderlust takes hold, safeguarding trips with travel insurance has never been more crucial. In an age of uncertainty, being prepared is no longer optional—it's essential.

Now, forget what you’ve heard about travel insurance being just another cost. It’s a lifeline in disguise for every globetrotter and backpacker. Did you know that some policies will even cover unexpected cancellations due to a family emergency or sudden geopolitical issues? But that’s not even the wildest part…

Consider this: traveling to certain countries without insurance can land you in more than just hot water—it could leave you with astronomical bills that rivals even the most elite vacations. There are hidden clauses and unexpected benefits that almost seem too good to be true. But what happens next shocked even the experts…

Skipping travel insurance might seem like a cost-saving move, but what about the hidden penalties? Picture this: a minor mishap like losing your luggage could spiral into a logistical nightmare. Without insurance, many travelers find themselves facing costs for replacements, emergency purchases, and even extra accommodation if the luggage is delayed. An unexpected twist: some insurance plans offer nearly immediate compensation for such inconveniences.

Medical emergencies while traveling present an even graver risk. Without insurance, an accident requiring hospitalization in a foreign country could lead to exorbitant out-of-pocket expenses. What you read next might change how you see this forever: some insurers cover emergency medical evacuations that could otherwise lead to hospital bills so steep, you wouldn't have imagined it. But there's one more twist…

Did you know that rental car mishaps while traveling can also be covered under travel insurance? It’s a little-known fact that can save a fortune. Without proper coverage, you could be liable for damages even if an accident wasn't your fault. But certain insurers include rental car protection, saving you from unexpected legal tangles and financial burdens.

The question remains: how much is peace of mind worth? The cost of an insurance policy might seem daunting, but consider the alternative. Some travelers have reported losses amounting to more than twice their vacation costs due to uninsured incidents. But that's not all there is to uncover about it...

The benefits of travel insurance go beyond just financial protection. Ever heard of 'concierge' services? Available through certain premium policies, they offer real-time assistance for rebooking missed flights, finding alternate accommodations, or even securing a dinner reservation at a fully-booked restaurant. These VIP-like services transform a potential travel crisis into a curated experience.

And here's something you might not expect: some insurance policies also cover unexpected travel inconveniences like trip delays due to weather. Such coverage means you won’t be out-of-pocket if you’re stranded at an airport during a snowstorm or hurricane. But hold onto your hats; there's more magic hidden in those fine print clauses...

If you’re one of those tech-savvy travelers, you’ll appreciate this: travel insurance can cover gadgets, too. Lost your smartphone or had a camera stolen? Some policies have personal effects protection, ensuring you're not left without your essential tech. This kind of coverage goes beyond convention, reflecting the modern traveler’s needs.

Lastly, did you know some policies offer 'cancel for any reason' clauses? It’s the ultimate flexibility perk—you can decide not to travel for virtually any reason and still receive partial reimbursement. But wait until you learn what's coming next in this insurance saga...

Reading the fine print isn’t glamorous, but it's essential when it comes to travel insurance. Did you realize that some policies don’t cover pre-existing medical conditions unless specifically included? This nuanced clause can determine the efficacy of your insurance and is crucial when traveling with specific health needs.

The devil is truly in the details: did you know that adventure sports coverage is often extra? If your journey includes bungee jumping in New Zealand or scuba diving in the Maldives, ensure your policy encapsulates these activities, or you might find your adventurous escapades uninsured. But nothing is ever black and white in travel insurance...

Consider this unexpected aspect: some insurers offer 24/7 multilingual support services, proving invaluable when faced with a crisis in a non-English speaking country. The support ensures not only communication clarity but also peace of mind. It’s an aspect that could define your entire travel experience during emergencies.

Beyond the core benefits, there's another layer to consider—how claims are processed. Responsive and straightforward claim processes might influence your choice more than initial costs. With slow claim resolutions, even the best policy could become a massive hassle. But what lies ahead will make you rethink everything about how insurance policies are chosen...

At the heart of every travel insurance decision is a simple question: is it worth the expense? Financially savvy travelers often conduct cost-benefit analyses before purchasing a policy. However, even with a small upfront cost, being uninsured might lead to substantial financial strain during an emergency. But there's a hidden gem in understanding the fiscal elements...

Barring heart-stopping accidents and unexpected natural disasters, travel insurance offers cost benefits in the form of safeguarded investments. Imagine this: you’ve booked a non-refundable luxury cruise, only to cancel due to unforeseen work commitments. With a cancellation policy, you recoup your investment without financial repercussions. This hidden aspect is a game-changer...

Moreover, when comparing insurance costs, consider the essential factor of customizing your policy according to your specific travel needs. Some policies offer add-ons, tailoring your insurance perfectly to your itinerary. A little more digging and you’d discover it’s not just insurance—it’s a travel partner.

Privileged far-seeing travelers leverage their insurance, buying peace of mind bundled with exclusive travel perks. A great policy isn't just a safety net—it's a full-fledged ally in your global journey. But the ramifications of your choice might surprise you...

Like any industry, the world of travel insurance isn’t without its darker hues. Some insurers employ tactics such as complex terms and low ceilings on coverage claims, making navigating policies a maze. By not reading the fine print, many travelers have faced claim denials due to innocuous details. It’s startling how often these minor details are overlooked.

The refunds promised may seem ironclad, but they come with strings attached. For instance, insurance might only cover incidents occurring during the trip's official duration. Other pre-trip mishaps, which affect travel plans, might fall outside coverage. But even that’s not where the surprises end...

Surprisingly, some travelers face long delays in reimbursement, causing financial strain. The reality of waiting over several months just to be compensated is not uncommon, urging a closer look at a provider's claim settlements record before making a choice. Confused already? There’s more you need to know...

Be aware of exclusions and stipulated excesses that significantly lower the reimbursement amount in the event of a claim. It’s not just about having insurance; it’s about having the right insurance. What the next section reveals just adds another layer of intrigue...

The digital world has revolutionized travel insurance. Comparison sites provide real-time quotes, showing comprehensive details like coverage limits and exclusions in naked transparency. This transition exploded onto the scene, simplifying what used to be a lengthy shopping process.

Mobile apps are the new powerhouse, offering instant policy purchases with a few clicks. This revolution is particularly resonant with younger travelers who value speed and convenience. But where this tech really shines is in managing claims, as some apps expedite the claims process from initiation to conclusion.

A paradox: despite technology’s convenience, the sheer volume of available options can overwhelm many travelers. So here’s a nugget of truth — the key isn’t in having multiple quotes, but in identifying which policies align with personal travel preferences and needs.

With all this technology at our fingertips, you'd think buying travel insurance is foolproof. But a surprising number of people still get caught in common missteps — something the next few pages will unravel in depth...

You would think that knowing the risks would make purchasing travel insurance an automatic choice. But psychological barriers often cloud judgment, leading travelers to rely on hope rather than security. Loss aversion theory explains this paradox, as people gamble with their finances under the belief that “it won’t happen to me.”

Fascinatingly, age plays a significant role in insurance uptake. Younger travelers, driven by spontaneity, are less likely to insure their trips, while older demographics, valuing security, tend to opt in. This divide is indicative of broader lifestyle differences, which become starkly apparent in decision-making patterns.

Motivations behind insurance hesitancy are layered, including distrust of insurance agencies and a lack of understanding about policy intricacies. These factors create a vicious cycle of hesitancy and misinformation, persuading travelers to defer finding suitable coverage.

Real stories of regret from uninsured travelers tell tales of woe that inspire chills more than horror movies. What follows might challenge everything you’ve assumed about traveling without insurance...

Meet Emily, an avid explorer who once brushed off travel insurance despite warnings. On a ski trip to Austria, a simple fall landed her in the emergency room. Hospitalization costs snowballed into substantial debt, dwarfing the holiday expenses. Her story now serves as a stark warning of the perils of overconfidence.

Then there's Jake, whose missed flight led to a domino effect of missed connections and hotel stays. Each new ticket, splurged on in panic, dug further into his savings. The irony? A travel insurance policy could have just offered reimbursement and peace of mind.

Consider Sarah, who ventured into the wilderness on a guided tour in Patagonia. A sudden change in weather turned an adventurous trek into a life-threatening situation, cut short by an emergency evacuation. With no insurance, the helicopter rescue cost her more than five years' worth of vacations.

These stories underscore a chilling reality: protecting ourselves means foresight and preparation. Yet the tales of these travelers offer one ray of hope—the next section reveals what they wished they’d known beforehand...

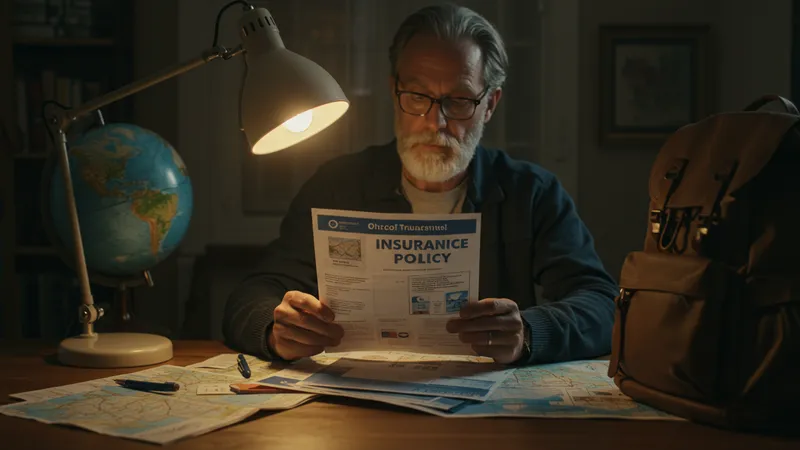

Wisdom passed down from seasoned globetrotters speaks volumes. First and foremost, conduct in-depth research—customize your policy to fit the nature of your travel, from coverage options to geographical scope. It’s not just a plan; it’s a travel lifeline.

Diligence in reading the fine print cannot be understated. Knowing what’s included and excluded ensures you're not blindsided and helps in selecting the best plan. When coverage specifics are understood, making claims become hassle-free.

Travelers will tell you—the most unexpected benefits come from choosing the right policy. While many overlook it, an annual multi-trip policy can sometimes offer substantial savings over multiple single-trip policies.

Ultimately, experts suggest keeping digital and paper copies of policies handy, ensuring seamless access during emergencies. This preparedness approach can transform unexpected events from havoc to manageable inconveniences. Yet what lies next in our journey of understanding could redefine your travel insurance perspective...

Travel insurance isn’t static. Emerging trends point toward personalized policies, with a focus on specific traveler needs influenced by past claims data and predictive analytics. The inclusion of pandemic-related coverages, too, has redefined what comprehensive means.

Insurance providers are also exploring 'behavior-based' policies, where premiums are calculated based on individual behaviors and risk profiles—a forward-thinking model inspired by health and auto insurance industries.

Micro-insurance policies are another buzzword. Offering short-term, limited coverage for specific activities or legs of the journey, these policies cater to the flexible needs of the modern traveler.

Looking ahead, integrating travel insurance with digital wallets and ecosystems stands to transform how policies are purchased and utilized. Continued innovations suggest a revolution in travel insurance both possible and imminent. But the culmination of this evolutionary process might just surprise you...

With any journey, information paves the way for confident decisions. Start by stacking your needs against policy offerings, aligning personal travel quirks with insurance solutions. This alignment gives rise to a roadmap for secure exploration.

It's not just coverage—it’s understanding past traveler missteps and victories that primes you for a well-insured vacation. The anecdotes and revelations shared shed light on the often-misunderstood travel insurance conundrum, encouraging mindful deliberation.

Another crucial layer is trust; engaging with reputable providers offering transparent policy terms reduces the burdens of unforeseen costs. It's about building a relationship of reliance and agency within an otherwise unpredictable travel experience.

Remember, the best policies grant more than monetary security—they proffer mental ease, assuring rich travel experiences unmarred by the uncertainty. The ending may be bittersweet, but the next notion uniquely ties this richly woven thread…

As travelers become more informed and demands more specific, insurers face an imperative to evolve. Stakeholders no longer dictate; instead, the consumer voice channels a pivotal shift in travel insurance narratives.

Social media platforms amplify traveler testimonies, both admiration and grievances. These discussions not only illuminate consumer sentiment but direct a spotlight on insurer practices ripe for refinement and innovation.

Moreover, the global shift towards ethical consumerism provokes insurers to adopt sustainable policies and promote transparency. Greater accountability beckons a refreshing horizon, one where policy selections are driven more by trust than necessity.

Real-time reviews, interactive forums, and expert blog insights create dynamic dialogue and foster informed decision-making. This era of open conversation promises a consumer-friendly spectrum of possibilities, awaiting in the final revelations on this journey...

Having journeyed through the depths of travel insurance, from gripping real-life mishaps to burgeoning innovations, the glaring truth remains: insurance is not merely paperwork. It assures peace during unforeseen challenges and instills the freedom to explore unimpeded. The takeaway? Travel may awaken the soul, but a solid insurance policy ensures it stays nurtured and secure.

As you muse over these insights, share this guide with those who dare to dream of distant lands. Bookmark it, scrutinize its nuances, and venture forth with bolstered confidence. The world awaits—and now, you're more prepared than ever to embrace it fully.