Did you know that car insurance premiums can vary by over 300% for two identical vehicles, simply depending on location? It’s true! With drivers everywhere tightening their belts, understanding the nuances of car insurance has never been more crucial.

As economic pressures mount, more people are reconsidering their car insurance options. Finding the hidden benefits and pitfalls in your current policy could save you thousands—if you know where to look. But there’s one surprising element most people overlook…

Here’s the kicker—many believe they’re fully covered when, in fact, certain fine prints and clauses can leave them exposed during a claim. For example, theft prevention often gets the spotlight, but do you know the specific scenarios where you’re truly protected? Strikingly, even seasoned policyholders find that understanding their coverage is akin to learning a new language. But that’s not even the wildest part…

Additionally, there’s a peculiar trend of “reputational insurance” gaining traction. Companies are increasingly measuring online reviews when setting premiums. Imagine a slight altercation turning into higher costs due to a negative review! The industry’s reliance on digital footprints is a double-edged sword that rewards those in the know. What happens next in this evolving landscape shocked even the experts…

Many drivers are unaware of the plethora of hidden discounts waiting to be unlocked within their current car insurance policies. Insurers offer significant savings from bundling home and auto policies to maintaining good grades for younger drivers. Yet, less than 20% of drivers take full advantage of these offers, leaving potential savings untapped on the table.

For instance, usage-based insurance programs are transforming how premiums are calculated, making it more fair and customized. Devices that track driving habits open new doors to discounts up to 40%, rewarding safer driving patterns. This approach is slowly revolutionizing the industry, yet remains under the radar for the average consumer.

Even more surprising, certain insurers offer “loyalty discounts” that reward long-term relationships with reduced premiums. Loyalty pays, quite literally, and understanding how these discounts stack over the years can lead to substantial savings. One small catch—ensure you compare the market regularly to gauge if loyalty truly outmatches shopping around.

But what you read next about deductible adjustments might change how you see car insurance forever. Many are starting to experiment with higher deductibles to save on upfront premiums, and what they’re discovering might just shock you.

It’s not just about the car you drive—where you live profoundly impacts your car insurance premiums. Urban dwellers frequently face quotes that are double or even triple those of rural residents, despite having similar driving records. This disparity often stems from varied risks, such as traffic density and crime rates.

Remarkably, moving even a few miles can trigger noticeable changes in your insurance costs. Insurers meticulously analyze ZIP codes to determine their risk profiles, considering factors like accident frequency, access to car repair services, and weather-related events. All these aspects mean your current address holds more sway over your rates than you likely imagined.

Are you surrounded by cul-de-sacs or multi-lane intersections? Such geographical nuances might dictate unexpected rate hikes or drops. But don’t despair; understanding this criterion means you can make informed decisions. However, there’s one aspect of regional insurance differences that experts are still uncovering.

These micro-geographical trends reveal astonishing nuances about policy adjustments. What you’ll discover next about “garage premiums” will refine your view, making you question every local insurance quote you receive. Don’t stop now—there’s one last twist that might just upend your expectations.

Bargain-basement insurance policies often lure unsuspecting drivers with temptingly low premiums only to leave them high and dry when it counts. The truth is, these policies frequently come with substantial exclusions and limitations, leading to unexpected expenses when accidents occur.

When diving into ultra-low-cost options, it’s crucial to examine what you’re truly purchasing. While the sticker price might look enticing, many of these policies trim essential coverages such as replacement for OEM (original equipment manufacturer) parts and limit liability coverage severely. The resulting “savings” may turn into burdensome bills post-claim.

Some drivers fall into the trap of perceived affordability. They think they're secured until they face an accident, which exposes the policy's hollow promises. But here’s where things take a turn—realizing the embedded inadequacies forces many to reevaluate their priorities toward more comprehensive coverage.

What you’ll discover next isn’t just about avoiding the pitfalls of cheap policies—it's about ensuring you’re getting what you pay for. This realization is reshaping the industry and could redefine your insurance strategy entirely. So, read on because there’s more to uncover on this transforming topic.

Choosing the wrong car insurance can feel like sailing a ship without a rudder. Too often, drivers pick policies based solely on initial cost, ignoring potential sacrifices in coverage. The aftermath? Devastating financial implications in the wake of unanticipated claims.

It's not just about coverage; it’s about aligning the policy with your lifestyle. For instance, frequent travelers might underestimate the need for rental car insurance or comprehensive theft coverage. Their oversight turns minor incidents into major headaches, with unexpected out-of-pocket costs looming large.

Physical damage coverage gaps can also leave drivers paying far beyond what they anticipated, thus challenge the reliance on fine print. By dissecting these clauses, you amplify your policy’s effectiveness while safeguarding against typical pitfalls. But you’re just scratching the surface—there’s more to unveil on tailoring the best-fit policy.

Insider advice frequently emphasizes the importance of reading all terms and conditions. Doing so arms you with the knowledge to customize policies precisely to need, avoiding typical oversights. But get ready, because our next section on the hidden traps of coverage limits will enlighten you further. Stay tuned!

Often, drivers see car insurance as a simple safety net without realizing how coverage limits draw the fine line between protection and exposure. Limited coverage may seem sufficient until an incident occurs, revealing potential catastrophic out-of-pocket expenses.

Many insurers set default limits, creating a false sense of security. The basic policy might include minimum liability coverage, which barely meets legal requirements. However, this base level may not suffice if you're involved in an accident, causing damages that exceed these low limits.

With rising medical and repair costs, minimal coverage can rapidly leave responsible drivers swamped with bills. Increasing limits often costs little but offers significant peace of mind. But delving deeper into these dynamics opens a whole new world of strategic decisions, awaiting your discovery.

The implications of underinsurance could haunt you, but there’s more to dig into with over-insurance complexities. Prepare to rethink how you approach balance in coverage, as our next page holds the keys to unlocking these mysteries. Keep reading!

Contrary to popular belief, having too much car insurance can be as detrimental as not having enough. Over-insurance leads to inflated premiums without proportional benefit, draining resources that could be allocated more wisely elsewhere.

Drivers often subscribe to excessive coverage as a safety measure, overshadowing what they truly need. This impulse not only strains finances but instills a false belief of impenetrable safety. Understanding your precise requirements is critical in avoiding these common over-insurance pitfalls.

Expert insights suggest reevaluating policies based on real risk factors rather than hypothetical scenarios that rarely materialize. This approach ensures premium alignments with genuine needs, saving precious financial resources in the long run.

But just when you think you’ve heard it all, another surprising aspect of right-sizing your insurance emerges. What you’ll learn next will shift your perception of insurance necessity and sparking a revolution in personal finance considerations. Stay alert to what’s coming!

Technology is revolutionizing car insurance, and its influence extends far beyond just apps and online quotes. Emerging technologies, like AI and telematics, are reshaping how insurers assess risk, offering more personalized premiums based on real-time data.

Insurers now leverage AI to accurately predict driver behavior, resulting in fairer pricing models. With continuous monitoring, policies can dynamically adjust, reflecting an ongoing alignment with the insured's actual driving habits. This thrives on data transparency and boosts consumer confidence.

Telematics devices, small yet powerful gadgets installed in vehicles, monitor everything from speed to braking habits, promoting safer driving practices. Insurers reward diligently safe drivers with notable discounts, bridging the conventional gap between potential and realized savings.

As we peel back more layers of tech integration, the conversation deepens, revealing how these advancements redefine traditional practices. The next revelation will astonish you with the latest industry transformations, leaving an indelible mark on your understanding of car insurance evolution. The story unfolds further…

Despite technological advancements, exceptional customer service remains a cornerstone of successful car insurance companies. Many consumers value human interaction in the highly automated insurance landscape, emphasizing empathy in responses over robotic efficiency.

When filing claims, policyholders often face emotional distress. Insurers with responsive representatives who provide clear guidance create lasting trust, demonstrating the irreplaceable value of esteemed customer service. The human touch remains irreplaceable in such situations, transcending cold data analysis.

Companies adept in blending robust technology with human compassion often report higher satisfaction levels. This interplay between tech and humanism forms a winning strategy, setting leading insurers apart in a fiercely competitive field.

However, there’s one crucial aspect of customer interaction that's frequently overlooked—a point that can redefine public perception entirely. What follows next in our exploration of the industry's future holds a compelling twist. Dive into the next segment, where we unravel more surprises!

As driving trends evolve, so do imperative shifts within the car insurance sector. Electric vehicles and autonomous cars are not mere novelties; they represent the zenith of automotive technology, dramatically altering traditional insurance paradigms.

The rise of autonomous vehicles brings forth previously uncharted territories, demanding new liability models. These groundbreaking innovations prompt insurers to reassess risk factors, accommodating unexplored challenges and opportunities alike in a futuristic landscape.

Interestingly, with EV adoption soaring, insurers also delve into battery duration concerns and sustainability aspects. These vehicles’ unique requirements initiate innovative insurance offerings, ultimately reshaping coverage scopes and premium structuring globally.

An exploration into these trends supercharges our perception of insurance’s adaptability. What you’re about to uncover next will captivate you with its implications and versatile strategies that cater to these revolutionary concepts. Prepare for further enlightenment!

Navigating the legal landscape of car insurance might seem straightforward, but hidden pitfalls could leave unsuspecting drivers in precarious situations, potentially facing legal action. Understanding the full breadth of your policy is more essential than ever.

Legal obligations vary significantly across jurisdictions, influencing coverage requirements and implicated responsibilities. Recognizing these variances prepares policyholders against missteps that might lead to costly legal misunderstandings or liabilities.

This intricate underlayer of insurance policies harbors nuances that the average consumer typically overlooks. Equipped with deeper insights, drivers can more effectively negotiate policy terms, ensuring alignment with both personal and legal expectations.

But there’s another layer you haven’t yet explored—an indispensable tool to navigate uncertain legal waters effectively. The upcoming segment will guide you through groundbreaking strategies, shattering preconceived notions. Don’t miss what’s next!

Loyalty programs can offer incentives that seem appealing, but they often require deeper scrutiny. While these programs reward long-term customers with discounts, they subtly impair competition, shielding insurers from price pressures and market shifts.

By fostering loyalty, insurers strategically reduce churn, prioritizing long-standing customers potentially at a disservice of competitive pricing. Understanding this dual-sanction dynamic is pivotal for consumers seeking maximum value from their insurance commitments.

It prompts a pivotal question: when does loyalty truly align with economic interests? This introspection leads many to periodically reevaluate their insurance portfolios, ensuring they harness genuine benefits over nominal discounts.

Dive deeper as upcoming insights reveal how adjusting loyalty strategies could propel your insurance experience forward. Pay heed to nuances, as uncovering these truths could redefine your approach entirely, inviting a reshaped insurance outlook. Read on!

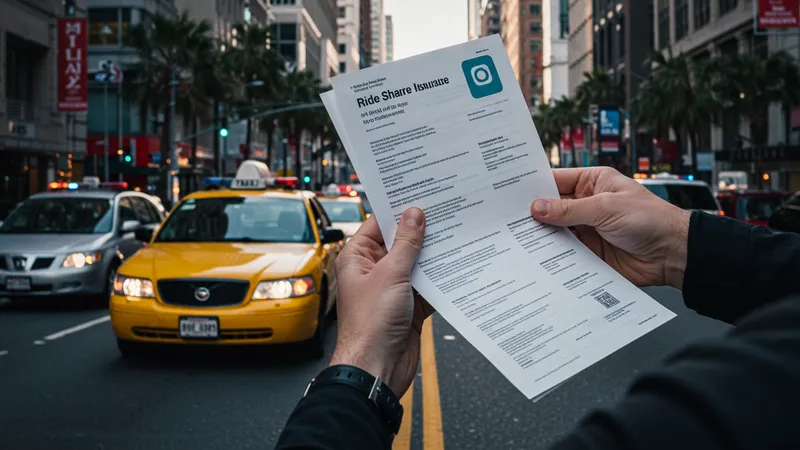

The surge of ride-sharing services has flipped traditional car insurance upside down, creating a hybrid model of personal and commercial vehicle usage. Insurers grapple with this paradigm, scrambling to cater to this significant industry shift.

Intended for personal use, most standard policies don't automatically cover commercial activities. Ride-share drivers face gaps in coverage, exposing themselves to unexpected liabilities unless specifically addressed with tailored policies.

Meanwhile, new players join the market, offering specialized coverage to these drivers, contingent on their unique needs. This competition forces established insurers to innovate rapidly or risk losing relevance among this burgeoning customer segment.

Consider how ride-sharing is reshaping not only vehicle ownership but also insurance architecture. The journey ahead unveils extraordinary revelations, propelling your understanding to a new horizon. More surprises await in the following chapters—stay tuned!

Roadside assistance is often seen as a necessary add-on, yet many misconceptions surround its actual value precisely during emergencies. Drivers may overestimate its comprehensiveness or underestimate its importance, leading to wrongly guided decisions.

Some insurance policies integrate roadside assistance without explicit clarity, making it a modest yet vital piece of the broader coverage spectrum. However, this seemingly minor detail might spell the difference between calm resolution and prolonged distress during breakdowns.

Evaluating these benefits against real-world situations provides a clearer, more precise picture of their efficacy. Car owners rethinking these options often discover newfound layers of reassurance and practicality beneath initial impressions.

But another unexpected myth of roadside benefits awaits as we peel back more layers, exposing lesser-known facets that reshape standard assumptions. What follows next is sure to intrigue and inform your forthcoming policy choices—read on to uncover all!

Amidst the complexities of car insurance, the final takeaway is a lesson in equilibrium. Balancing cost with adequate coverage ensures peace of mind, securing you against unforeseen liabilities without unnecessary burden. Every driver's needs are different, making thoughtful comparisons and attentive policy reviews critical steps toward achieving optimal insurance health.

So, what's your next move? Share your insights, bookmark this piece for transformation, or take an action step towards reevaluating your insurance landscape. Your journey doesn’t stop here—let’s change the narrative together, one policy at a time.