Did you know that most Indian freelancers lose more money to taxes than any other expense? In India, filing an Income Tax Return (ITR) is not just a matter of legal compliance—it's a financial game-changer. Those who master it could save a fortune.

Filing ITR as a freelancer in India is more crucial today than ever before. Why now, you ask? Thanks to updates in the tax code, coupled with the growing gig economy, understanding tax nuances can mean the difference between flourishing or floundering financially.

Here's the surprising part: many freelancers fall into significant tax traps thanks to sheer neglect or misinformation. The cryptic jargon of deductions, rebates, and GST complications can lead to major financial pitfalls. They miss out on benefits they deserve due to simple ignorance. But that’s not even the wildest part...

What if I told you there’s a loophole legal and savvy freelancers use to cut their tax bills by half? No, this isn't about some shady offshore account. It’s a provision hidden deep within the tax laws, almost like a cheat code for freelancers. Yet, most remain unaware. But what happens next shocked even the experts…

To start, let's run through the fundamentals of ITR filing for freelancers. The most common form used is ITR-4, designed for professionals with a total income under ₹50 lakh who opt for the presumptive income scheme. It’s meant to simplify things, but complexities abound. Interestingly, understanding which form to use might save you a fine of up to ₹10,000 for incorrect filing, a common misstep!

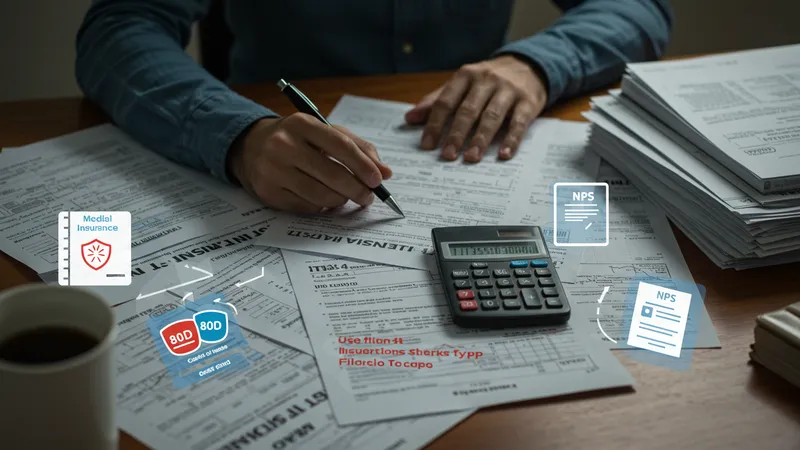

Filing your ITR isn’t just about punching numbers; crucially, it also involves knowing which deductions you’re entitled to. Think of medical insurance premiums under Section 80D or contributions to the National Pension Scheme (NPS) under Section 80CCD. These can considerably lower your taxable income, but freelancers often overlook them. But there’s one more twist you might not expect...

Did you know that maintaining a separate bank account for your freelance earnings and expenses can streamline your tax filing? Combining personal and business finances often leads to tangled audits. This simple shift can prevent future headaches and is a strategy recommended by tax advisors that many fail to capitalize on. What you read next might change how you see this forever.

The principle of estimating your advance tax payments right cannot be overemphasized. Missing an installment or under-assessing your payable amount can incur hefty penalties. It’s an area even seasoned freelancers sometimes slip on, proving that excitement lies in the details you never see. Now, brace yourself; the following information will flip the script on taxes entirely...

A jaw-dropping reality most freelancers face is overlooking deductible expenses. Everything from your home office setup to internet bills can be written off, yet many fail to document properly. What’s shocking is the cumulative saving lost here could afford a luxury vacation annually!

Software subscriptions, marketing expenses, and even coworking space rentals can be leveraged for deductions. It's crucial, however, to maintain sharp documentation to back these claims. Tax audits are rare, but they happen, and being unprepared is costly. Now, here’s where it gets even more interesting—did you know about specific deductions just for digital content creators?

For instance, freelancers operating via platforms like Upwork or Fiverr can write off service fees imposed by these intermediaries. Additionally, if you're using a percentage of your car mileage or mobile bill for work, these too can be claimed. Yet, according to surveys, only 30% of freelancers utilized these deductions last year. Better catch up!

Don't underestimate the power of actual receipts and virtual proof. Receipts, electronic invoices, and payment slips are gold when you’re trying to substantiate your expenditures. Take this step, and you're more likely to see a freelancer's dream transition: from owing tax to receiving refunds. Here's the kicker—the effect this has on your financial stability is revolutionary...

How about a tax scheme that lets you declare just half of your earnings for tax purposes legally? Introducing the presumptive taxation scheme, a game-changer many are unaware of. It's designed for professionals with gross receipts of up to ₹50 lakh, levied at a flat 8% of turnover. But here’s the kicker—it can effectively cut your tax bill in half.

It’s especially beneficial for newer freelancers or those with modest earnings fluctuating annually. Opting for this scheme reduces not just taxes but also significantly simplifies compliance with fewer bookkeeping demands. Most don't leverage this, thinking it's irrelevant to their situation, but they're leaving free money on the table!

However, choosing this route means a commitment to the same for the next five years. If in any year taxes are filed conventionally, backtracking isn’t an option until the completion of this period. It's a requirement set by the taxman that’s not widely known but vital to be aware of.

This scheme is a relief that preserves your focus on work rather than endless paperwork and audits. The contrast between those who know of it and those who don’t is typically substantial tax savings, illustrating dramatic earning retention. What you’ll discover next is the kind of loophole even accountants wish they knew sooner...

India's tax code is a dense jungle, but when properly navigated, offers hidden trails of savings through lesser-known exemptions. Freelancers often discover too late that simple eligibility changes like declaring investments in certain government funds or bonds can lead to significant shifts in tax liabilities. Imagine the surprise when these shifts recover half your paid taxes!

Did you know that donating to specific charitable institutions could secure a 50% to 100% exemption under Section 80G? Or that investing in startups eligible under Section 54GB might defer your capital gains tax? Many freelancers overlook these simple yet effective strategies, resulting in unnecessary tax payments.

Another thrilling exemption lies within the transport system, where telecommuting allows claims on vehicle depreciation and related fuel costs under standard mileage rates. A legal trick known by few that can tear down taxable earnings surprisingly.

Taking full advantage of these can transform your financial bottom line. The trick lies in exploring IRS-approved lists, updating your knowledge continuously, and recognizing that tax-saving opportunities are everywhere, hiding in plain sight. Up next, ride the wave of these secrets as we delve deeper into surprising scenarios...

The technological landscape has radically transformed the tax filing scene, with interactive tax calculators becoming game-changing allies. These tools automate deductions eligible for specific freelancer activities, revealing potential savings otherwise missed. An eye-opener lies in how some found savings they never expected through technology's analytical precision.

TurboTax India offers predictive insights based on previous filings, a feature turning guesses into science. Compare this with ClearTax, which has specifically tailored guidance for freelancers looking to minimize tax impacts. It’s like having a personal tax advisor who never sleeps!

Even Google Sheets has evolved with templates designed by savvy tax experts, allowing freelancers to visually map expenses, income, and contributions, illustrating a clearer financial forecast. The impact? A sense of control and informed decision-making that can mitigate risks and maximize gains.

Using these tools doesn’t just enforce financial discipline; they elevate the freelancer’s status from financially surviving to thriving, utilizing exact figures and data at the tax filing table. Decode more on how this technological evolution places power back into freelancers' hands in the astonishing pages to follow...

Do you frequently estimate your earnings before they hit the primary tax bracket? Welcome to self-assessments, a taboo-breaking practice distinguishing successful freelancers from struggling ones. It’s a forward strategy enabling freelancers to forecast, budget, and prepare tax expectations, eliminating surprise penalties.

A tax audit might initially sound intimidating, but freeing up misconceptions reveals it's often the moment of clarity needed to adjust strategies substantially. Surprisingly, while tax audits underline vulnerabilities, they frequently highlight hidden strengths—not doom as widely perceived. Think of them as unexpected allies!

What many freelancers ignore is the symbiotic relationship between self-assessment and tax audit trends. By closely analyzing these patterns over time, it’s possible to foresee tax obligations, averting potential financial crises with educated foresight, a practice mostly shrouded in mystery.

This journey from uncharted territory to informed tax filing employs a methodical view—observative, always proactive. It crafts a unique, liberating narrative between earnings and taxes, shifting the narrative away from dread and into opportunity. What you're going to learn now might just revolutionize how you approach taxes entirely...

The ever-evolving landscape of technology is disrupting traditional taxation processes at breakneck speed. Today, AI-driven platforms dip deep into vast data pools to optimize freelancer tax filings, practically eliminating human errors. The startling realization being future filings may require little to no human intervention!

Tools like AI tax bots learn from each transaction, reducing manual data entry, while blockchain-powered verification offers real-time insights into tax obligations. This not only fosters transparency but ensures freelancers align real-time income with taxes promptly.

The rise of mobile apps offering 'tax filing on-the-go' services is gaining momentum too. Imagine drafting your taxation paperwork amid the bustle of a train commute—a modern marvel of convenience previously unimaginable. This amalgamation of tech and taxation is pivotal for freelancers seeking simplicity.

These tech paths are shaping the future freelancer's journey, minimizing stress levels, maximizing efficiencies, and setting up undeniable dynamics in tax and earnings management. Stay tuned as we next uncover hidden cost patterns silently affecting your bottom line!

Yet, the weightiest story isn’t just in tax dollars but in peace of mind. The psychology of tax compliance among freelancers has typically been one overlooked mental aspect fuelling procrastination and tax woes. Knowing your finances are squared leads to mental comfort—an immeasurable benefit.

Studies reveal freelancers facing tax dilemmas are more prone to anxiety and creative blocks, hindering output quality and volume. But here's where it takes a twist: proactive tax strategies shield freelancers not just financially but emotionally. They transition from fear-based indecision to empowered financial choices.

The difference manifests palpably in professional and personal spheres, unlocking dormant potential when freed from regulatory anxiety. It’s the oft unmentioned backbone of a thriving freelancing lifestyle—a tool for personal liberation many aren’t utilizing enough.

This engaging journey into psychological dynamics offers more than a fresh perspective; it beckons the adventurous freelancer to explore complexities of both tax laws and self-awareness. Check out what's in store next—it might just set new standards for financial serenity...

In an age characterized by community-driven approaches, freelancers increasingly tap into collective wisdom for tax solutions. Platforms that host crowdsourced tax advice are booming and delivering real-world, applicable insights, often proving more relatable than formal consultation.

Forums and social media groups cater to the collaborative learning of freelancers, offering DIY tax hacks that prove ingenious, forged from shared experiences. Sometimes, street-smart, time-tested advice outperforms standard procedures in surprising ways—it's democratization of financial prudence!

For the curious freelancer not intimidated by unorthodox methods, this platform becomes a playground for innovation. Here, members challenge, vet, and validate ideas, ensuring an evolving landscape where breakthroughs materialize continually.

From inquiry to enlightenment, the power of knowing you’re not alone permeates every financial decision. Coupled with formal advisor input, crowdsourcing transforms monetary perceptions from intimidating to engaging—an unexpected hero for the independent worker. What unveils next will weave this community influence into your freelance ethos remarkably...

While taxes form a crucial core of financial literacy for freelancers, broad planning encompasses retirement and investments. Tax-aversion isn’t the ultimate goal but a pathway to broader financial autonomy encompassing multiple life aspects demanding attention simultaneously.

Pension accounts like NPS, though occasionally overlooked in favor of immediate gains, secure longer-term safety nets many fail to consider. This strategic oversight often proves detrimental when spanning decades of career-building engagements.

Investment linkages coordinated with tax strategies add layers leniently, introducing much-needed elasticity to fiscal paradigms. Harnessing market instruments alongside savvy taxation establishes a resilient, multifaceted portfolio necessary today.

Ultimately, this holistic view challenges freelancers to seek financial fluency continuously. It’s an enlightened mix of adventurous frontiers intertwining personal and professional development inseparably. And now, for the final revelation—a storytelling crescendo redefining conventional expectations forever...

The biggest lies about tax filing for freelancers have been uncovered. But the greatest truth remains: preparation is power. By equipping yourself with knowledge and leveraging every available tool, you transform unforeseen tax burdens into manageable investments. This constant growth path, fortified by innovation and community, sets a precedent changing freelancer futures irreversibly. Take this newfound wisdom and impart it further—freedom awaits your pioneering spirit!