Did you know there is accounting software so intuitive that it feels like it reads your mind? That's right. The latest wave of accounting tools brings unparalleled ease to bookkeeping. Why have we been relying on spreadsheets for so long?

In a world where financial transparency and efficiency are paramount, understanding these solutions is crucial. From solo entrepreneurs to thriving small businesses, the right accounting software can make all the difference. The future of accounting is here—it’s smart, savvy, and surprisingly affordable.

Consider this—some businesses have cut financial overheads by 50% using these tools. Digital accounting isn’t just for tech-savvy entrepreneurs anymore; it’s approachable and increasingly common in every sector. But that’s not even the wildest part…

Traditional accounting methods are rapidly becoming obsolete. With automation and artificial intelligence, today’s software can predict cash flow needs and generate financial forecasts with startling accuracy. But imagine a tool that also provides you with real-time insights and actionable data… What happens next shocked even the experts…

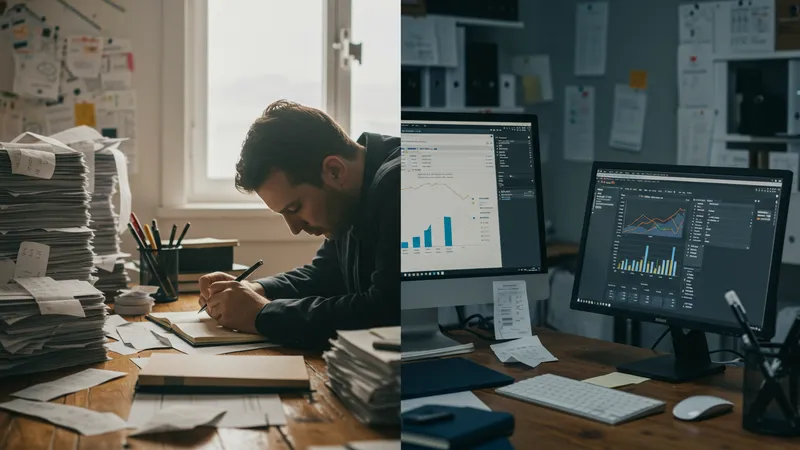

For countless small businesses, manual bookkeeping isn't just time-consuming—it's costly. Missing receipts, lost time, and manual data entry errors add up fast. Did you know that businesses spend approximately 120 hours annually on manual accounting tasks? That's non-revenue generating labor that could be drastically reduced with software.

By moving to automated systems, businesses have increased financial accuracy by upwards of 90%. The money saved goes back into business growth and innovation. Yet, switching from manual to automated accounting isn’t a decision to take lightly. There are hidden hurdles, including the learning curve that often dissuades business owners. But there's one more twist…

Adoption of cloud-based solutions can seem daunting at first, but these tools are designed for users of all tech backgrounds. With step-by-step guides and customer support, the changeover is smoother than anticipated. Case studies show firms recovering their software investment in under a year. What you read next might change how you see this forever.

Yet, the benefits of shifting to automated accounting extend beyond just financial metrics. Teams report higher job satisfaction and less stress when they switch, freeing up resources to focus on other strategic pursuits. Intrigued? Discover the ins-and-outs of the most popular software solutions in the next section. Are these tools truly transformative? You be the judge.

Today’s accounting tools boast an array of features that were unimaginable just a decade ago. Picture this: automatic invoice reminders and tax calculations done seamlessly. But most intriguing is what these tools do behind the scenes. Imagine getting your weekend back because month-end reports are auto-generated, ready by Monday morning.

Revolutionary features like integration with bank accounts allow for real-time transaction imports—no need for the old manual input errors. Gone are the days of reconciling accounts well past midnight. Some software even suggests tax-saving moves ahead of your CPA meeting, saving not just time but also hard cash.

Are you curious about how machines not only understand but can also manage fiscal needs themselves? Then dive deeper into how artificial intelligence is being baked into even the simplest accounting platforms. The sophistication of these tools makes one ponder what else could be automated in our finance departments.

Before becoming too reliant on technology, it's essential to ask: Are there risks involved here? What about data security? The security measures like multi-factor authentication and encryption built into these tools are more robust than most typical client email systems. Now, prepare to be surprised by the statistics in the upcoming section; it will redefine your perspective on expense management.

In the realm of accounting, one of the most cumbersome areas has long been expense management. From crumpled receipts to confusing expense reports, the process has always been fraught with pitfalls. But technology is changing that narrative dramatically.

With software solutions, capturing expenses has never been sleeker. Simply snapping a photo of a receipt with your smartphone can auto-populate expense reports in real-time. Builders at remote sites or salespeople in bustling cities need only a few taps to keep records updated seamlessly. This ease offers a significant return on time and efficiency.

Surprisingly, the financial reconciliation process has become faster too, with many businesses having reduced errors by a staggering 80% through these tech aids. The direct linking of credit accounts allows faster matching of expenses, which means less time verifying transaction details. An unexpected benefit has been the level of data-driven insights managers now have into employee spending behavior and discrepancies.

So what might appear as high-tech frivolity initially is fundamentally elevating and simplifying business operations. Next, we’ll delve into how these tools stay up-to-date with taxation laws, an area often feared by many small-business owners. What you find may dissolve some deep-seated tax anxieties.

Artificial Intelligence and Machine Learning are not just buzzwords—they are transforming tax compliance. Imagine never missing a tax deadline or overlooking a deductible because your software flagged it for you. Today's solutions track changes in tax codes to keep businesses compliant without a single Google search.

The AI's ability to learn from data patterns means it’s not only faster but also more precise in capturing tax-saving opportunities. This ensures accuracy and the best financial fallout for businesses aiming to maximize every dollar. Users report a significant reduction in tax penalties, attributing it to AI-powered insights.

Tax season can be a less daunting experience when you’re prepared ahead of time. AI technology can even predict potential cash flow issues during high-tax months and suggest corrective measures. But how far can AI truly go in ensuring businesses comply without falling into the traps of legislative changes?

The more you trust these systems, the more they learn, offering greater personalization and efficiency. Consider how much stress and human error AI has removed from tax processes. Get ready to unearth the truth about the simplicity and immense benefits these advancements bring as we venture further.

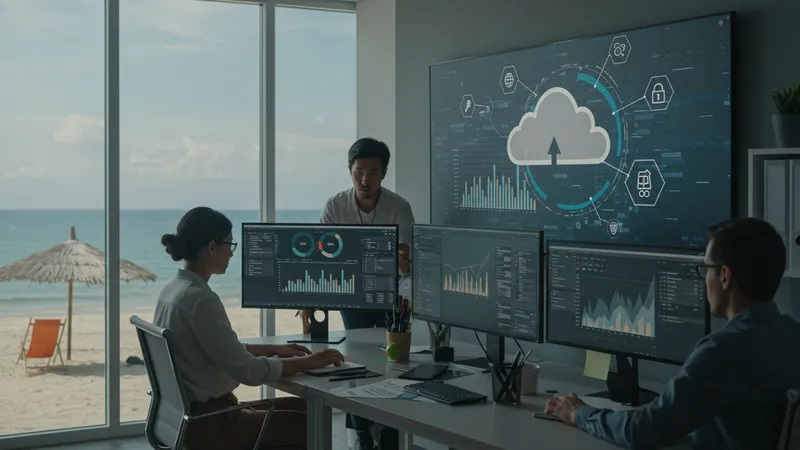

Cloud-based accounting solutions are not just for large corporations anymore. Small businesses often find themselves neatly tucked into the cloud's benefits without overwhelming investment. The immediate perks include secure access from any device, anywhere—whether it’s an impromptu meeting in a cafe or a beachside brainstorm.

But cloud solutions offer more than just convenience. Redundancy and in-built data recovery strategies minimize business risks during technical failures. For instance, businesses that previously relied on single machines have embraced the cloud to counter threats like hardware failure or site-specific calamities.

Still, some remain apprehensive about data security in the cloud. Despite these concerns, leading solutions employ high-grade encryptions that meet or exceed industry standards, ensuring data isn't just stored, but protected with vigilance. Don't overlook enhanced collaborative features—multiple users can work concurrently on differing devices to expedite tasks.

Would moving to the cloud make financial management a more seamless part of your business operation? Next up, discover which small businesses have been game-changers in leveraging these solutions, thanks to real-world applications you won’t want to miss.

Success stories abound when it comes to embracing modern accounting software. Take the case of a small boutique in Chicago; their transition saw a revenue boost within three months, simply by efficient expense tracking. Empowered with time-sensitive insights, managers could make proactive decisions instead of reacting post-factum.

Similarly, a fledgling tech startup turned their financial landscape around by adopting comprehensive accounting tools. Predictive analytics became their guide, assisting them in securing crucial funding rounds. The insights gleaned from historical data helped them perfect their pitch to investors.

Restaurant owners, often involved in day-to-day operations, have shifted non-customer interface time to core service improvements thanks to automated reporting and mobile app interfaces. The time saved equates to enhanced service and bolstered customer satisfaction—directly linking streamlined finances to customer experience.

These small yet significant wins revolutionize how businesses perceive their growth and strategy. Imagine these tools as partners rather than applications. Think this sounds dramatic? See the next section to understand how cost-effectiveness plays a role in this growing love affair with technology.

There’s a reason why more businesses are migrating to automated software: the return on investment (ROI) is concrete. Consider this: a recent survey revealed advertisers increased their financial metric comprehensibility by over 60% after the switch, thereby optimizing ROI on marketing spend.

Cost-effectiveness in software isn’t just about purchasing affordability but the longer-term financial outlay that it avoids. Using manual methods is not only time-consuming but costly. Invest in technology and you subtract error costs and time-consuming recalibrations from your ledger.

Yet, it extends beyond dollars saved. The reduction in stress and increased trust in financial data boosts operational morale, making companies not just fiscally smarter but holistically healthier. What else goes into making these tools financially appealing? The competitive pricing structures add to the attraction.

With adjustable plans subject to user needs, businesses focus more on progression rather than price weighing. Envision the closing gap where operational adeptness and creative freedom intertwine to shape potential for further growth. The following section dials down on choosing between popular options based on specific distinct needs.

Finding the ideal accounting solution can feel like solving a complex puzzle. Software diversity speaks to all kinds of businesses, industries, and scales. So how do you discern what's right for uniquely specific needs? It starts with introspection: What do you need it to do most?

Consultant businesses, heavy on client billing, may lean toward something with streamlined invoice functionalities. Meanwhile, retail outfits often require inventory integration. Your decisions hinge on operational nuances. Don’t let an abundant feature list cloud your core necessities.

Look beyond features; think compatibility and adaptability. Avoid getting swept away by the flash of add-ons yet to be time-tested. Seek trials, weigh user experiences, and heed community feedback. Ultimately, your tool should align with and enhance your current process, not complicate it.

The software landscape provides flexibility, catering to startups dreaming big and micro-firms focusing on community service. Could you be skipping crucial details? Next, let's uncover expert perspectives on integrating these solutions into daily operations successfully.

Flawless integration of new systems can be daunting; expert guidance can tip the scales in your favor. Seasoned pros swear by strategic planning, punctuating every step with precision. A collective effort, predicated on clarity, avoids disruptions.

Pre-integration analysis and ongoing training are pivotal. Evaluate existing processes—what works, falls short, or contributes to bottlenecks. Assimilate software functionalities with business goals and train teams accordingly to bridge any knowledge gaps.

Experts often recommend pilot runs in tandem with existing methods. It limits fallout during the learning phase, fostering confidence without sabotaging ongoing operations. Don’t underestimate the power of roundtable discussions; input from all levels leads to comprehensive strategy understanding.

Is your team ready to evolve along with your tools? Finally, expert tips on extracting ongoing value from advanced software help ensure long-term success as businesses tap into new opportunities granted by these alignments.

Once implemented, the ongoing value of accounting software is contingent on its utilization. Regular updates and system adjustments enable businesses to stay on target, leveraging the tool's full potential. The journey doesn't culminate at setup—it evolves continually.

Encouraging ongoing learning within teams and harnessing workshops enhances skill sets and keeps everyone at the cutting edge of accounting software capabilities. Businesses that remain adaptive and open to innovation witness greater software benefits curvature.

Moreover, as the business expands in complexity, the software should grow alongside. Outsourcing assistance or consultation during pivotal shifts—a new product launch or structural change—ensures continued sweating of assets at peak efficacy.

Is sustained value a priority within your enterprise? Let us delve into how top players continually learn, leading to improved decision-making and greater business agility. Want to know which industry leaders are the models for smart adaptation?

Prominent names in tech and business epitomize accounting proficiency with software integrations. From ecommerce rulers to locally revered CPA firms, they’ve made technology their ally, a hallmark of adaptive success.

Companies like Amazon rely heavily on quick access to financial snapshots—this is disseminated through advanced accounting software. The French firm Kering, which owns Gucci, exemplifies flair in financial dexterity, using software to govern intricate supplier chains deftly.

Can small businesses replicate these big players' success? With the right approach, aligning software to daily operatives ensures smarter business decisions, rapid responses, and ultimately, market competitiveness.

The examples set forth by these giants serve as aspirational models. Reimagining business dexterity is not reserved for conglomerates; even small fish in vast ponds exude confidence and resilience. Encounter the future leaders building their enterprises, next in line for greatness, as we draw our curtain on key takeaways.

The insights captured from trailblazers in accounting technology illuminate a path for businesses striving toward their ambitions. Their stories underscore the importance of embracing innovation, continually learning, and seamlessly integrating systems.

Learning from their playbooks means adopting a proactive stance. Remaining wary of the evolving marketplace helps maintain a competitive edge, thereby allowing room for calculated risks and unparalleled opportunities.

The world of accounting isn't static; it's dynamic and more automated. From guiding participants toward sharper decision-making to fostering cultures of continuous improvement, smart integration is transformative.

Having glimpsed the precipice of opportunity through this series, the ultimate local adoption awaits, fueled by insight, strategy, and the determination to excel. The next frontier pivots on these principles as you contemplate your own cutting-edge turn.

As the accounting landscape evolves, one thing remains clear—tools adapted to your unique business needs can create a tactical edge that is hard to ignore. Whether you're a solopreneur or a seasoned small business owner, the right software can be a game-changer. Remember the transformation is not just in process but perception. Equip yourself, adapt, and lead.

If this narrative inspired a shift in perspective, share it with your network. Bookmark this page for a continual reminder that innovation fuels success. Embrace the future armed with data-driven decisions and watch your business flourish.